In a previous post, I indicated that entrepreneurs benefiting from the Financial Shield should determine their status based on the European Commission’s Recommendations on the definition of SME. These Recommendations were subsequently reiterated in Annex 1 to Commission Regulation (EU) No 651/2014 of 17 June 2014 declaring certain types of aid compatible with the internal market in application of Articles 107 and 108 of the Treaty (OJ EU L 187 of 26.06.2014, p. 1, as amended10).

It appears that the scope of the SME definition applicable under the Financial Shield is not clear to everyone. Entrepreneurs and some lawyers have mistakenly assumed that the PFR programme documentation has 'narrowed’ the EU-wide definition and that when determining one’s status for the purposes of the programme, one does not need to take into account the details of related or partner entities. In other words, that a medium-sized entrepreneur in the Financial Shield programme means something different from a medium-sized entrepreneur in the EU sense.

The update to the Regulations published by PFR , as well as the Communication of the Polish Development Fund published on 17 May 2020. Communication of the Polish Development Fund S.A. on the definition of small and medium-sized enterprises eligible to participate in the governmental programme „Financial Shield of the Polish Development Fund for Small and Medium-Sized Enterprises ” finally dispel doubts about the definition of an enterprise used in the competition.

The aforementioned programme documents explicitly refer to the definition of SME included in Annex 1 to Regulation 651/2014 and indicate that entrepreneurs applying for the subsidy should take into account the data of partner/affiliated enterprises when determining their status.

EU definition of SM

There have been comments in the public space indicating that the definition of an enterprise in the Financial Shield should be limited to the definition of an SME in the Enterprise Law, which is a narrower definition (it does not include, inter alia, affiliated/partner enterprises).

As I indicated in a previous post, the starting point for the inclusion of an EU-wide definition of SMEs is the European Commission’s 2003 Recommendations on the definition of SMEs , which indicate that they refer to the definition of micro, small and medium-sized enterprises as applied in EU policies and in the European Economic Area, whereby Member States, the European Investment Bank (EIB) and the European Investment Fund (EIF), are requested to comply with Title I of the Annex for their programmes targeting medium-sized, small or micro enterprises.

At the same time, Article 2 of the Recommendations indicates that the ceilings indicated in Article 2 of the Annex are to be regarded as maximum values. Member States, the EIB and the EIF may set lower ceilings. In implementing some of their policies, they may also choose to apply only the criterion of the number of persons employed, except in areas that are subject to different State aid rules.

The provisions of the Recommendations were then reflected in the content of Annex I to EC Regulation 651/2014 on block exemptions of various categories of state aid.

These provisions are now referred to in a number of legal acts – aid programmes adopted by Polish institutions for the purposes of state aid, both from EU and national funds. These provisions are also referred to in the Act on the System of Development Institutions on the basis of which the Polish Development Fund, among others, provides aid to entrepreneurs. Article 12 of the SIR Act reads:

The Polish Development Fund provides financing, in particular to micro, small and medium-sized entrepreneurs meeting the conditions set out in Annex I to Commission Regulation 651/2014.

Does business law 'narrow' the definition of SME

In explaining this issue, it is worth starting from the fact that the Law on Entrepreneurs, and earlier the Law on Freedom of Economic Activity, never defined the concept of an enterprise for the purposes of state aid. Moreover, historically, there was a direct provision in the Freedom of Economic Activity Act (art. 110), which – in terms of state aid – referred to the EU definition of SME, common for the entire area of the European Union.

Article 110(1) of the Act on Freedom of Economic Activity indicates that an entrepreneur applying for public aid shall submit a declaration before the body granting the aid that it fulfils the conditions set out in Annex I to Commission Regulation (EC) No 800/2008 of 6 August 2008 declaring certain categories of aid compatible with the common market in application of Articles 87 and 88 of the Treaty (General Block Exemption Regulation) (OJ L 214 of 09.08.2008, p. 3)

Thus, the Act on Freedom of Economic Activity directly referred to EU regulations regulating the status of an enterprise. An analogous regulation was already missing in the Entrepreneurs’ Law, which does not mean that the change of regulations should have been treated as a 'narrowing’ of the definition of SME in Polish law in relation to EU law. On the contrary, the authors of the Entrepreneurs’ Law clearly indicated that the definition of SME contained therein did not in any way conflict with the EU definition, which should be applied for the purposes of state aid.

The legal definitions of micro-, small and medium enterprise contained in the PrPrzed provisions have no normative significance for the way in which these concepts are understood for the purposes of the provisions of European Union law on state aid and for the purposes of Polish regulations on state aid and implementing provisions of European Union law in this respect, and the definition of micro-, small and medium enterprise contained in the relevant provisions of EU law should be applied in the field of state aid law (Justification of the draft act - Entrepreneurs' Law, Druk sejmowy VIII kadencji Nr 2051, pp. 24-25).

Does the European Commission's decision 'change' the definition of SME

Voices in the public arena calling for a 'return’ to the allegedly narrow definition of SMEs used in the Financial Shield justify such a return by the content of the European Commission’s decision approving the Financial Shield programme. Those who formulate such postulates – including lawyers – refer to the content of the European Commission ’s decision approving the Financial Shield programme, which allegedly consented to the 'narrowing’ of the EU definition of an entrepreneur to the definition from the law on entrepreneurs, in addition to the law on entrepreneurs.

According to the EC decision, the beneficiaries of the Financial Shield programme remain SMEs within the meaning of the Entrepreneurs’ Law (paragraph 16 of the decision). Does such a reference imply acceptance by the European Commission of a different definition of SME than the EU one, in particular, does it mean that links between entrepreneurs should not be taken into account? In my view, no.

As I indicated above, the definition of SME adopted in business law is not a complete definition. The legislator had the right – in accordance with the Recommendations – to adopt in national law different – stricter – ceilings than the EU ones – concerning the definition of SMEs. However, in accordance with the Recommendations of the European Commission, national law cannot – apart from establishing stricter ceilings – interfere with the definition of SME in the case of granting state aid. It is therefore impossible to assume that the Entrepreneurs’ Law limits or narrows the definition of SME by excluding from it the fundamental issue of the assessment of links between enterprises.

The fact that the Entrepreneurs’ Law does not include provisions on links between enterprises does not mean that they do not apply to scheme participants.

Freedom to determine the circle of those entitled to aid versus the 'selectivity' of a measur

Notwithstanding the above remarks, in my opinion the mistake related to the perception of the Financial Shield programme is related to the wrong perspective. The European Commission did not mandate, as the proponents of the „national” definition of SMEs correctly point out, to differentiate the legal status of aid beneficiaries depending on their belonging to a specific group – SMEs or large ones. Under the Temporary State Aid Framework, aid granted under section 3.1 of the framework was not made conditional on the specific status of the entity in question.

The designation of the circle of beneficiaries of the scheme is within the framework of setting the conditions for support. The European Commission did not impose a requirement that certain forms of support should go exclusively to SMEs or that these entities should be treated more favourably than others (although several times in the Communication on the Temporary Framework the EC points out that it is SMEs that have suffered most).

State aid, by its very nature, refers to a situation where a given support measure is not applicable to all – it is 'selective’. A member state has – determined by the treaty limits – a freedom to define groups of entrepreneurs to which it directs support, assuming that the conditions of support are transparent and the reference system can be established in a precise manner. As I indicated above, the definition of SME in the Enterprise Law is not a complete definition and for the purposes of state aid it should also take into account the EU regulations and recommendations, only then will the reference system be constructed in a precise way.

In a situation where a Member State itself decides that it intends to differentiate the situation of beneficiaries depending on their specific status as entrepreneurs (SME or large) – as is the case in the Financial Shield, precisely for the sake of the principle of transparency of support, the EU definition of SME should apply, which will ensure that entities that are not in fact SMEs do not benefit from support under privileged conditions, depriving other 'real’ SMEs of aid.

Definition of SME and conditions for support

At the same time, this does not mean that all entities in the SME or large group are to receive support. It is one thing to have an EU definition of an enterprise and a methodology for determining its status, and another to have the programme author define the conditions for support. Not all entities from the SME group have to be treated equally - support may be limited in different ways, e.g. by making the aid conditional on a certain number of employees - also in a specific form, length of business activity, experience or other characteristics of the contributor, etc. However, it is not possible to stipulate within an aid scheme that a different definition of a large entrepreneur than the one in force under EU law will be used for its purposes

It is one thing, therefore, to lay down conditions for support in respect of which the entity granting support has a degree of freedom, albeit limited by treaty rules, and another to define SMEs in a common way throughout the European Union. Therefore, if the author of the Financial Shield programme decided to address support separately to a group of SMEs and separately to large enterprises, he could not modify the EU definition of SMEs by indicating in the text of the programme certain categories of beneficiaries meeting specific conditions.

Probably, it would have been much more skilful to use an editorial move indicating, for example, that: „the beneficiaries of the scheme remain SMEs within the meaning of Annex I to Regulation 651/2014 which, as at 31 December 2019, including related/partner entities, employ […]”, as is used for other aid schemes. However, the definition adopted in the aid scheme does not constitute an interference with the EU definition of SME, but incorporates certain support conditions that the beneficiary must meet.

The definition of the group of beneficiaries of the programme cannot, however, in any way modify the EU definition of an SME. Therefore, reading the European Commission’s definition as „narrowing” the definition of SME within the meaning of the EU is incorrect. Only SMEs within the meaning of the EU which at the same time meet the conditions of an SME within the meaning of the aid programme – the Financial Shield – may be beneficiaries of the aid.

This is confirmed by the content of the PFR communication, which clearly indicates that the support is directed to a group of SMEs within the meaning of the EU regulations.

In conclusio

Opposing views in favour of allowing entrepreneurs without links to participate in the PFR scheme would not only lead to a narrowing of the EU definition of SMEs, but also to a significant market distortion and exclusion from aid measures of entrepreneurs genuinely in need of aid, who will not receive this aid due to the finite nature of the measures. This is why the EU definition of SMEs requires data from affiliated companies to be included in the calculations to reflect their actual strength. The market position of enterprises that are connected, whether by equity or by natural persons, is completely different from that of a „pure” SME. Allowing entrepreneurs who are not SMEs to apply would lead to depriving those in real need of support. One of the important market advantages of groups of enterprises is easier access to financing, which, in the other direction, is seen by the European Commission as one of the important barriers. By giving aid to large enterprises, the state would at the same time deprive genuine medium-sized entrepreneurs of this aid – which is granted under certain conditions.

However, advocates of changes to the SME definition are not without options – it is important that this is done in the prescribed manner. The European Commission periodically, every couple of years, conducts a survey on the need to update the definition of SME, as part of which industry organisations and member states can take a stand. I wrote about the need to update the SME in the context of Polish entrepreneurs some time ago in the entry„Is an update of the SME definition needed?„. . I myself am in favour of updating this definition, because the economic reality of our domestic entrepreneurs shows that the number of employees, for example, does not necessarily reflect the real strength of an enterprise, and can sometimes even depict its backwardness. Nevertheless, the change of the definition should take place at EU level in the prescribed manner and not by artificially modifying the EU definition of an SME in national law.

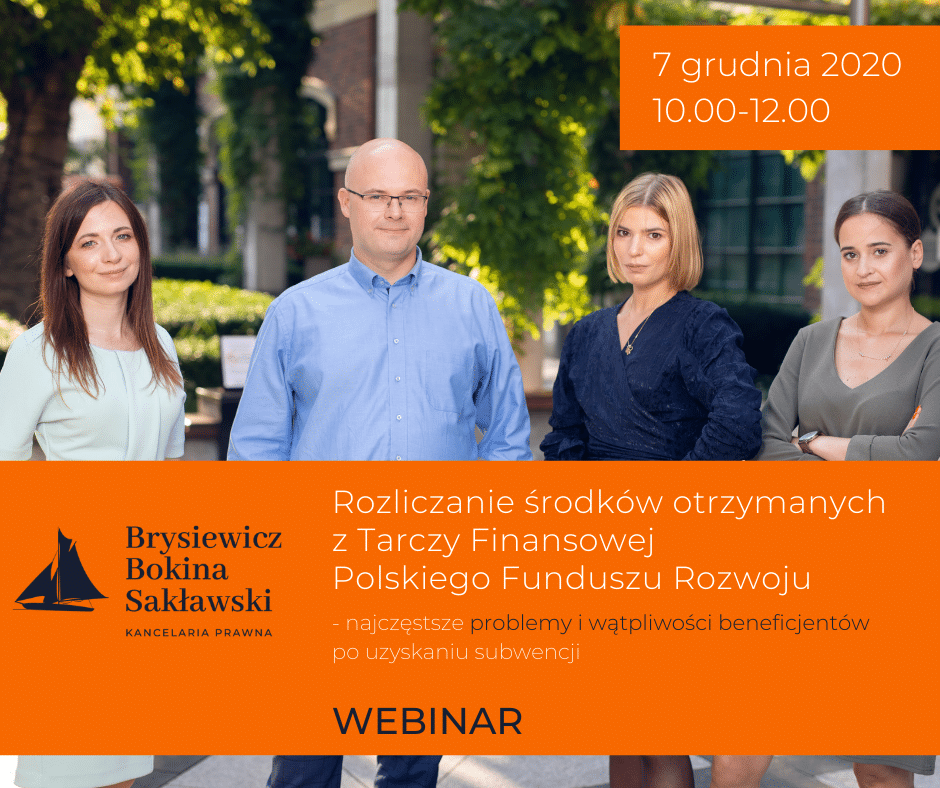

Experts from the law firm BBS i Wspólnicy from the EU Funds and State Aid practice, invite all beneficiaries of the Polish Development Fund’s Financial Shield S.A. (large companies and representatives of SMEs), to participate in a free webinar to be held on 7 December from 10.00 to 12.00.

During our virtual meeting, we will jointly discuss both 🔹problems arising at the subsidy application stage, which may result in the need for reimbursement, as well as 🔹future changes in the legal or factual situation of companies affecting the support granted under the Financial Shield.

We will also comment 🔹 on the scope and course of a possible audit of the disbursement of funds provided by the PFR and its consequences and the beneficiary’s preparation process prior to the audit. 🔹We will advise on how to proceed in practice in the event of a risk that a subsidy has been wrongfully collected.

This is an unusual opportunity to get answers to a number of burning questions related to the settlement of PFR Financial Shield funds.

About author

Contact for media

Ask the author a question

Ask the author a question